Bitcoin's recent tumble below $90,000 has, predictably, set off alarm bells. The headlines scream "bear market," and the crypto-Twitterati are, as usual, oscillating between hopium and despair. But let's cut through the noise and look at what the data actually tells us.

The primary driver seems to be a one-two punch of macroeconomic uncertainty and waning ETF enthusiasm. The Fed's reluctance to signal imminent rate cuts is throwing a wet blanket on risk assets across the board, and Bitcoin isn't immune. We're seeing outflows from those shiny new spot Bitcoin ETFs. Bloomberg data pointed to the second-highest daily outflow on Thursday. After all the hype, the institutional floodgates haven't exactly opened.

The ETF narrative was always a bit too simplistic. The idea was that easy access would unlock a new wave of demand. And it did, initially. But the market's a bit more nuanced than that. As 10X Research noted, there's currently "no meaningful marginal buyer stepping in." This is the crucial point. The existing buyers, the true believers, are already in. The marginal buyer is the one who’s swayed by market sentiment, by the promise of quick gains. And those buyers are fickle.

The other factor at play is the government shutdown. The strategist Sean Farrell points out that the government shutdown lasted longer than investors expected, and a liquidity boost from renewed spending will take time to seep into the economy.

The question is, where do we go from here? Vetle Lunde at K33 Research suggests that if the current drawdown mirrors the two deepest drawdowns over the past two years, a bottom may form between $84,000 and $86,000. If not, he adds, "a revisit of the April low and MSTR’s average entry of $74,433 may be a natural leg lower." It's a wide range, to be honest. Bitcoin (BTC) Price News: Back Below $90K as Crypto Correction Ranks Among Worst

Beyond the macro picture, some technical indicators are flashing warning signs. The "death cross" – when the short-term moving average dips below the long-term – is never a welcome sight. It suggests that the recent downturn isn't just a blip, but a potential shift in trend.

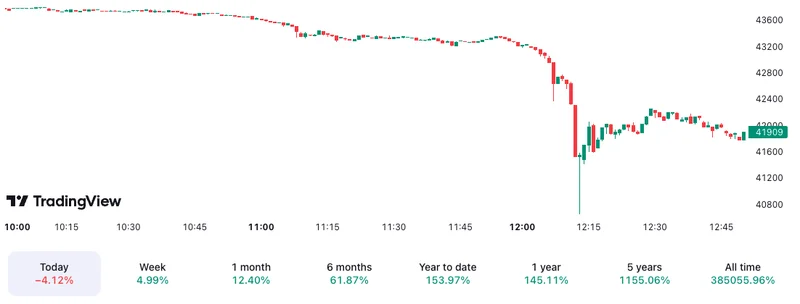

Then there's the liquidation cascade. Over $19 billion in crypto positions were wiped out earlier this month, triggering forced selling. This is the leverage monster rearing its head. Crypto derivatives markets are notorious for their volatility, and when prices start to fall, leveraged positions get liquidated, exacerbating the decline. It's a self-fulfilling prophecy of sorts.

The Crypto Fear and Greed Index is, unsurprisingly, pinned in "Extreme Fear" territory. Sentiment is a contrarian indicator, of course. But "extreme fear" can also paralyze potential buyers. This is the part of the report that I find genuinely puzzling. We've seen these cycles before. The market gets euphoric, then corrects, then panics. And yet, each time, the same emotional roller coaster plays out. Are we really learning anything?

The idea that institutional adoption would somehow insulate Bitcoin from volatility was always a fantasy. Institutions are driven by profit, not ideology. They'll buy when the price is going up, and they'll sell when it's going down. The ETF flows are just one more data point confirming this.

The long-term thesis for Bitcoin remains intact, in my view. But the path to mass adoption is rarely a straight line. We are seeing increased adoption, as more countries begin to accept Bitcoin as legal tender, or allow for it to be mined within their borders. It's going to be volatile, and it's going to be frustrating. But if you're in it for the long haul, these corrections are just opportunities to accumulate.

The current market correction isn't really a surprise. Bitcoin has always been volatile. However, what is surprising is the level of fear and uncertainty surrounding the current correction. Are investors concerned about inflation? Are they concerned about the upcoming election? Or are they concerned about the Fed? The data shows that investors are concerned about all of these factors. Bitcoin in 'bear market regime' as cryptocurrency falls below $95,000

Bitcoin's correction is a classic case of macro headwinds meeting leveraged speculation. The ETF narrative needs a serious reality check. Long-term potential remains, but expect more volatility ahead.